Millions of Americans rely on Social Security as a key component of their monthly income, making any changes to benefits an important topic. In 2026, Social Security recipients may see adjustments to their payments due to the annual Cost of Living Adjustment (COLA). Even modest increases can make a tangible difference in managing essential expenses such as rent, groceries, utilities, and healthcare.

Understanding how Social Security benefits are calculated, what drives annual increases, and how payments are adjusted can help beneficiaries plan their finances with confidence.

Why Social Security Benefits Increase Annually

Social Security benefits are designed to keep pace with inflation through the Cost of Living Adjustment. COLA ensures that the purchasing power of beneficiaries does not erode as prices rise. Without these adjustments, monthly benefits could lose value over time, leaving retirees and other recipients struggling to cover essential costs.

The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). When sustained inflation is detected, the Social Security Administration applies an increase to benefits for the following year, helping payments reflect the current cost of living.

The 2026 COLA: What We Know So Far

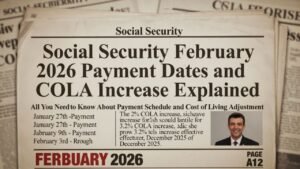

As of early 2026, the official COLA rate for Social Security has not yet been finalized. The SSA typically announces the adjustment in October, after reviewing inflation trends from July through September. Early projections suggest that the 2026 increase may be smaller than the unusually high adjustments seen in recent years, though even moderate increases can provide meaningful relief for households living on fixed incomes.

It is important to note that until the official COLA is confirmed, all figures remain estimates. Beneficiaries should plan with caution and refer to official announcements for precise numbers.

How COLA Will Affect Monthly Payments

Once the 2026 COLA is applied, increases are automatic. No action or paperwork is required from beneficiaries. Adjusted payments will begin with the January 2026 benefit, and subsequent monthly payments will continue to reflect the new amount.

COLA adjustments apply across multiple Social Security programs, including:

- Retirement benefits

- Disability benefits

- Survivor benefits

While everyone receives the same percentage increase, the actual dollar amount varies depending on the size of the current benefit. Recipients with higher payments will see a larger absolute increase, while those with smaller benefits will experience more modest yet meaningful changes.

Supplemental Security Income (SSI) Adjustments

Supplemental Security Income, which provides financial support to eligible low-income individuals, is also tied to COLA adjustments. The federal portion of SSI payments will increase in line with the approved COLA, although the final payment may vary depending on state supplements, income, and living arrangements. SSI recipients should monitor official notices to confirm the exact amounts.

When Higher Payments Will Arrive

Beneficiaries can expect to see the updated payments starting in January 2026. Social Security checks and direct deposits will automatically reflect the new amounts. Many recipients also receive a COLA notice outlining their updated monthly benefits and any deductions, such as Medicare premiums. Reviewing this notice carefully ensures clarity and helps avoid confusion when deposits differ from previous months.

How Medicare Premiums Affect Net Payments

While COLA increases Social Security benefits, deductions for Medicare Part B premiums can affect the net amount received. If premiums rise, the actual increase deposited may appear smaller than the overall COLA adjustment. Beneficiaries should account for this when planning their monthly budgets.

What Beneficiaries Should Do Now

No action is required to receive the 2026 Social Security increase. However, staying informed and organized can help make the transition smooth:

- Review benefit statements and COLA notices

- Monitor direct deposits for accuracy

- Understand deductions, including Medicare premiums

- Consult official SSA resources for personalized guidance

These steps ensure that beneficiaries fully understand their payments and can plan their finances accordingly.

Why This Increase Matters

Even modest COLA adjustments can provide significant relief for households dependent on Social Security. For many retirees, individuals with disabilities, and survivors, monthly benefits form the backbone of household budgets. Keeping pace with inflation helps protect purchasing power and maintain financial stability in an uncertain economic environment.

Understanding how COLA works and when adjustments take effect allows beneficiaries to plan effectively for both expected and unexpected expenses.

Conclusion

Social Security benefits in 2026 are set to increase through the annual COLA, helping recipients keep up with inflation and rising living costs. While the official COLA rate has not yet been finalized, adjustments will automatically apply to retirement, disability, survivor, and SSI benefits, starting with January 2026 payments.

By staying informed about COLA, reviewing notices carefully, and considering deductions like Medicare premiums, beneficiaries can manage their finances with greater clarity and confidence. The annual adjustment may seem modest, but for millions of Americans, it provides meaningful support in navigating everyday expenses.