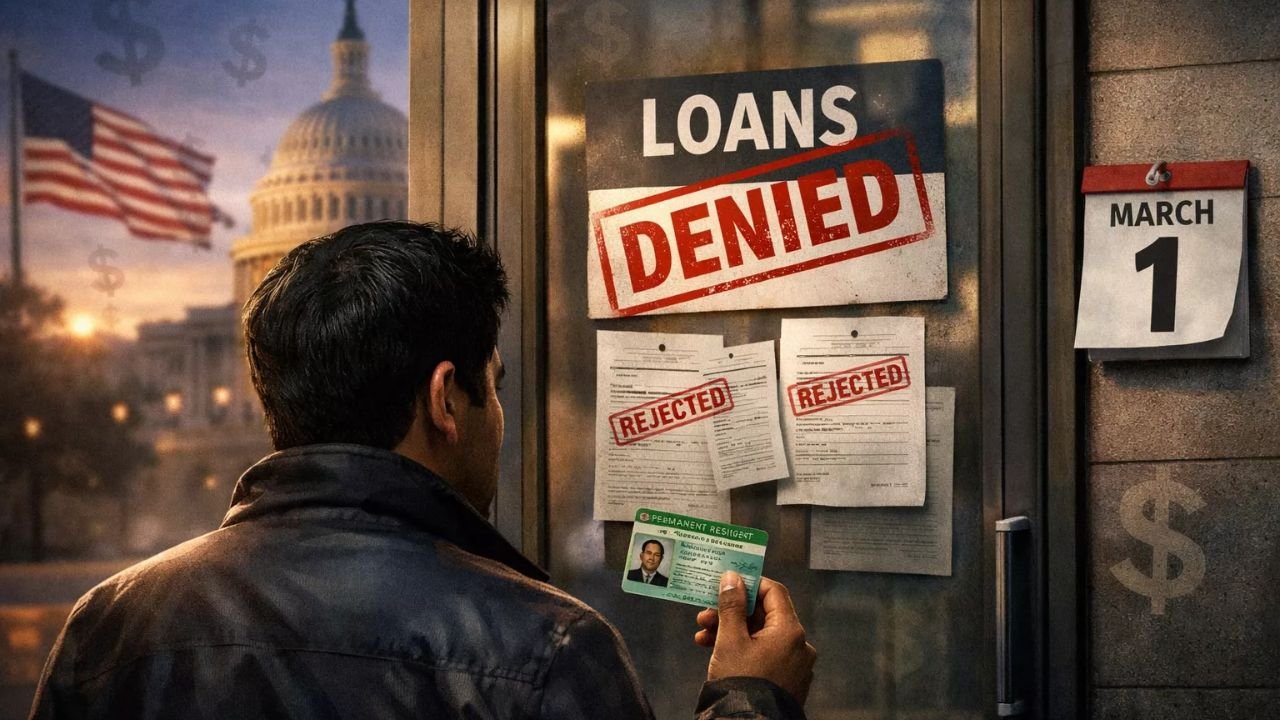

Green card holders lose access to US government-backed business loans starting March 1, a policy shift that is already reshaping the funding landscape for immigrant entrepreneurs across the United States. For decades, these loan programs have played a critical role in helping permanent residents launch businesses, expand operations, and contribute to local economies through job creation and innovation.

With rising interest rates, persistent inflation, and higher operating costs, the timing of this change has raised serious concerns. Many small business owners who relied on predictable, affordable financing must now reassess their financial strategies. Understanding what changed, who is affected, and how to adapt is essential in this new environment.

What Changed Starting March 1

From March 1 onward, permanent residents who are not US citizens are no longer eligible for most federally backed business loan programs. This shift stems from stricter enforcement of existing eligibility rules rather than the introduction of a new law.

In practice, this means green card holders lose access to US government-backed business loans that were previously available through agencies such as the Small Business Administration. The change caught many business owners off guard, with some discovering the update only after loan applications were rejected or delayed.

The absence of a broad public rollout or transition period has added to confusion, particularly for entrepreneurs who were in the middle of expansion plans or refinancing discussions.

Why Government-Backed Loans Matter

Government-backed loans are designed to reduce risk for lenders while providing borrowers with favorable terms. Lower interest rates, longer repayment periods, and reduced collateral requirements make these programs especially valuable for small and growing businesses.

When green card holders lose access to US government-backed business loans, they are often pushed toward private financing options that are more expensive and less flexible. This can strain cash flow, delay growth initiatives, and increase long-term financial risk.

For many immigrant-owned businesses, these loans represented the difference between sustainable growth and financial stagnation.

Who Is Most Affected by the Policy Shift

Permanent residents who have not yet obtained US citizenship are directly impacted. This includes first-generation entrepreneurs, minority-owned businesses, and family-run enterprises that rely heavily on structured financing.

Startups and younger businesses face the greatest challenge. Government-backed loans often serve as an entry point to formal credit markets for companies with limited operating history. Even long-term green card holders who have paid taxes and operated successful businesses for years are affected equally under the revised enforcement.

The rule does not differentiate based on business performance, revenue, or community impact.

Types of Loans No Longer Accessible

Several key financing programs are now out of reach for green card holders:

SBA 7(a) loans, commonly used for working capital and expansion, are no longer available.

SBA 504 loans, often used for real estate and major equipment purchases, are also restricted.

Government microloan programs face tighter limits, reducing accessibility.

Certain disaster assistance loans now come with additional eligibility barriers.

These programs previously offered stability and predictability that private lenders rarely match.

Reasons Behind the Decision

Federal agencies point to compliance clarity and eligibility alignment as the primary reasons for the change. Loan guarantees are now more narrowly interpreted to apply only to US citizens.

Risk management concerns and broader political pressure to limit access to federally supported programs have also influenced enforcement. While officials emphasize consistency, critics argue the policy overlooks the economic contributions of immigrant entrepreneurs.

As enforcement tightens, green card holders lose access to US government-backed business loans without sufficient transition support, leaving many businesses exposed.

Economic Impact on Local Communities

The impact extends beyond individual business owners. Small businesses are a cornerstone of local economies, providing employment, services, and neighborhood stability.

When affordable capital becomes harder to obtain, hiring slows and expansion plans are postponed. Communities with high concentrations of immigrant-owned businesses may experience reduced economic activity and slower recovery from recent economic disruptions.

Green card holders lose access to US government-backed business loans at a time when resilience and adaptability are critical for small business survival.

Alternative Funding Options to Consider

While government-backed loans are no longer available, alternative funding options exist, though often with trade-offs.

Private bank loans remain an option but typically come with higher interest rates and stricter underwriting.

Online lenders offer faster approvals but at significantly higher costs.

Credit unions may provide more favorable terms, though approval timelines are often longer.

Angel investors and private equity can supply capital but may require ownership stakes or control concessions.

Each alternative requires careful evaluation to avoid long-term financial strain.

Steps Green Card Holders Can Take Now

Business owners should act proactively to adapt to the new funding environment. Strengthening personal and business credit profiles is a key first step. Clear financial documentation, consistent cash flow, and reduced debt can improve eligibility with private lenders.

Some entrepreneurs explore partnerships with US citizen co-founders to regain access to certain programs, though this approach requires careful legal and operational planning. State-level grants, nonprofit funding initiatives, and local economic development programs may offer limited relief in specific industries.

As green card holders lose access to US government-backed business loans, early planning becomes essential to maintain stability.

Conclusion

The financing environment for immigrant entrepreneurs has changed significantly. Green card holders lose access to US government-backed business loans from March 1, affecting growth strategies, hiring plans, and long-term business stability.

While alternative funding sources are available, they often come with higher costs and stricter conditions. Staying informed, strengthening financial fundamentals, and exploring diverse capital options can help business owners navigate this transition. With strategic planning and adaptability, immigrant-owned businesses can continue to thrive and contribute meaningfully to the US economy.

FAQs

What does this policy change mean for green card holders

Permanent residents can no longer access most federally backed business loan programs.

Are existing government-backed loans affected

No, loans approved before March 1 remain valid under their original terms.

Can green card holders still obtain business financing

Yes, through private lenders without federal guarantees.

Is US citizenship now required for SBA loans

Yes, under the current enforcement interpretation.

Which businesses are most impacted

Small, startup, and immigrant-owned businesses face the greatest challenges.