The first Social Security payments of 2026 are scheduled to arrive next week, marking the start of a new benefit year for millions of Americans. For retirees, individuals with disabilities, and survivors who depend on monthly benefits, the first deposit of the year is more than routine—it sets the financial tone for the months ahead.

While payments are arriving on schedule, the amounts may look different from what beneficiaries received at the end of 2025. Some changes reflect annual updates designed to protect purchasing power, while other parts of the system remain steady and predictable. Here is what to expect.

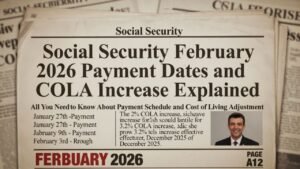

When the First 2026 Social Security Payments Will Be Sent

The Social Security Administration continues to follow its established payment calendar in 2026.

Individuals who receive Supplemental Security Income (SSI) are typically paid at the beginning of each month. Likewise, beneficiaries who began receiving Social Security benefits before May 1997 generally receive payments early in the month. If a scheduled payment date falls on a weekend or federal holiday, deposits are issued on the preceding business day.

For most other recipients, payments are distributed based on date of birth:

- Birthdays between the 1st and 10th: Paid on the second Wednesday

- Birthdays between the 11th and 20th: Paid on the third Wednesday

- Birthdays between the 21st and 31st: Paid on the fourth Wednesday

This staggered system helps ensure smooth processing for millions of accounts. Importantly, there are no structural changes to the payment schedule for 2026.

What Makes the First Payments of 2026 Different

The most noticeable update in January’s payments is the inclusion of the annual Cost-of-Living Adjustment (COLA). This adjustment is designed to help benefits keep pace with inflation and rising living costs.

The COLA increase is applied automatically. Beneficiaries do not need to complete forms or contact the Social Security Administration to receive it. The new benefit amount is already reflected in the first payment of the year.

For many households, this first deposit provides a tangible understanding of how the adjustment impacts monthly income.

Understanding How COLA Affects Individual Payments

COLA is calculated as a percentage increase, not a flat dollar amount. As a result, the actual increase varies from one person to another.

Beneficiaries with higher base benefit amounts will generally see a larger dollar increase. Those receiving smaller monthly benefits will experience a more modest rise in absolute terms. This structure ensures proportional adjustments across the system.

While the percentage applied is uniform, the dollar difference in deposits can vary significantly. That difference reflects the individual’s existing benefit level rather than any special recalculation.

Why Some Net Deposits May Not Rise as Expected

Although the COLA increase raises gross benefit amounts, some beneficiaries may notice that their net deposit has not increased as much as anticipated.

This is often due to deductions that are automatically withheld before the payment reaches a bank account. The most common deduction is Medicare Part B premiums. If Medicare premiums rise, they can offset part of the COLA increase.

In practical terms, the total benefit amount may be higher, but the final deposit—after deductions—may show only a slight change.

Reviewing official benefit statements can clarify the difference between gross and net payments.

The Role of Medicare Premium Adjustments in 2026

For many recipients, Medicare premiums are deducted directly from Social Security benefits. While this automatic process simplifies billing, it can also create confusion when benefit adjustments occur.

If Medicare costs increase in 2026, the higher premium may reduce the visible impact of the COLA increase in the monthly deposit. Beneficiaries should compare:

- Total monthly benefit amount

- Medicare Part B premium deduction

- Any additional deductions, if applicable

- Final net deposit

Understanding these components can make budgeting more accurate and transparent.

No Changes to Core Eligibility or Payment Rules

Despite periodic rumors that circulate online, there are no major changes to Social Security eligibility rules or benefit formulas at the start of 2026.

There are no special bonus checks, stimulus-style payments, or one-time supplemental deposits tied to the first payment of the year. The increase visible in January’s deposit is part of the routine annual adjustment process.

Eligibility requirements, claiming strategies, and retirement age rules remain consistent with established federal guidelines.

Any official updates to an individual’s benefit outside of standard annual adjustments would be communicated directly by the Social Security Administration.

Why the First Payment of the Year Matters Financially

For many households, Social Security represents a primary or sole source of income. The first payment of the year plays a key role in financial planning.

Seeing the updated amount deposited allows beneficiaries to:

- Reassess monthly budgets

- Adjust savings or spending plans

- Account for healthcare costs

- Plan for recurring expenses

The first deposit provides clarity that written notices alone may not deliver. It confirms exactly how much income will be available each month throughout the year.

For retirees managing fixed-income lifestyles, this confirmation is essential.

What Beneficiaries Should Review After Receiving Their Payment

Once the first 2026 payment arrives, beneficiaries should take a few minutes to review their account details carefully.

Consider checking:

- The total benefit amount

- Medicare premium deductions

- Any tax withholding, if elected

- The final net deposit

It is also wise to ensure that contact details and direct deposit information on file with the Social Security Administration are accurate and up to date. Small administrative issues can lead to delays, and verifying information early helps prevent complications later in the year.

If any discrepancies appear, contacting the Social Security Administration promptly can help resolve them.

A Stable Start to the 2026 Benefit Year

The arrival of the first Social Security payments of 2026 marks a stable and predictable beginning to the year. While updated benefit amounts reflect inflation adjustments, the overall structure of the system remains unchanged.

Payments are being processed on time. The schedule remains consistent. There are no hidden rule changes or unexpected program shifts.

For millions of Americans, that stability is just as important as the annual increase itself.

By understanding how COLA adjustments, Medicare deductions, and payment timing work together, beneficiaries can approach 2026 with greater confidence and financial clarity.

Disclaimer

This article is for informational purposes only. Social Security benefit amounts, payment schedules, and deductions are governed by official Social Security Administration rules and may vary by individual. Readers should rely on official SSA communications or consult a qualified professional for personalized guidance.