The first Social Security payments of 2026 are set to arrive next week, bringing relief and certainty to millions of Americans. For retirees, people with disabilities, and survivors who rely on these benefits, the initial deposit of the year is more than just routine—it’s a critical part of managing monthly expenses like rent, groceries, utilities, and healthcare.

While payments are arriving on schedule, the amounts many beneficiaries see in their accounts may differ slightly from last year. Some changes are new for 2026, while other aspects of the system remain unchanged.

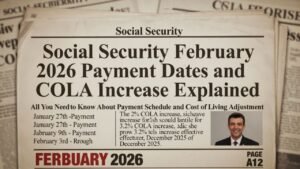

When Payments Will Be Sent

The Social Security Administration (SSA) continues to follow its established payment schedule. Individuals receiving Supplemental Security Income (SSI) and those who began collecting Social Security before May 1997 typically receive payments at the start of the month. Unless a weekend or holiday causes a minor adjustment, these deposits generally arrive within the first few days.

Other beneficiaries receive payments later in the month, based on their birth date. The SSA sends these deposits on specific Wednesdays to ensure smooth processing for millions of recipients, and this schedule remains consistent for 2026.

What’s Different About the First 2026 Payments

The most notable change in early 2026 is the updated benefit amount, which reflects the latest Cost of Living Adjustment (COLA). COLA is applied automatically each year to help Social Security benefits keep pace with rising prices, meaning there’s no need to submit forms or contact the SSA to receive it.

For many beneficiaries, the first deposit of the year is when the COLA increase becomes tangible, as it appears directly in their bank accounts.

How COLA Affects Different Beneficiaries

COLA is calculated as a percentage increase rather than a flat dollar amount. Consequently, the actual increase varies from person to person. Individuals with higher monthly benefits will see larger dollar increases, while those with smaller benefits will experience smaller increases.

This percentage-based system can create confusion for some, but it is not indicative of inequality—it simply reflects how adjustments are calculated.

Why Some Payments May Not Seem Much Higher

Even with COLA applied, some recipients may notice that their deposit has only slightly increased compared to last year. The primary reason is deductions, particularly Medicare Part B premiums. If premiums rise, they can offset a portion of the COLA increase, making the net deposit appear smaller.

Medicare Deductions and Your Net Payment

For many beneficiaries, Medicare premiums are automatically deducted from Social Security checks. While this simplifies payment management, it can make the net increase less obvious. Reviewing benefit statements and deductions can clarify why your deposit differs from expectations and aid in accurate budgeting.

What Has Not Changed in 2026

Despite circulating rumors, there are no adjustments to the payment schedule, no bonus checks, and no extra one-time payouts this year. Eligibility rules and benefit formulas remain consistent. Any actual changes are always announced officially by the Social Security Administration.

Why the First Payment Matters

For households that depend on Social Security, the first deposit of the year sets the tone for monthly budgeting throughout 2026. Seeing the updated amount allows beneficiaries to plan, adjust spending, and gain confidence in managing finances over the coming months.

What Beneficiaries Should Do Now

Once your first payment of 2026 arrives:

- Review the deposited amount and compare it with your benefit notice.

- Check deductions, including Medicare premiums.

- Ensure your bank account and contact information are current to avoid delays.

- Keep official SSA communications handy for reference throughout the year.

Taking these steps helps prevent issues and ensures smoother financial planning for the months ahead.

Conclusion

The first Social Security payments of 2026 are arriving next week, incorporating the latest COLA adjustments and continuing the SSA’s regular schedule. While the net deposit may vary due to deductions, understanding the timing, calculation method, and deductions can help beneficiaries plan effectively. Staying informed and reviewing statements ensures that households can manage their finances confidently throughout the year.

Disclaimer: This article is for general informational purposes only and is not financial or legal advice. Social Security benefit amounts, deductions, payment schedules, and eligibility rules are determined by the Social Security Administration and may vary based on individual circumstances. Readers should refer to official SSA communications or consult a qualified professional for guidance specific to their personal situation.