For generations, retirement planning in America followed a predictable script: work steadily, reach age 67, and claim full Social Security benefits. That age became more than a policy benchmark—it became a psychological milestone. Millions structured their careers, savings strategies, and long-term goals around it.

Today, that certainty is beginning to shift. Demographic changes, longer life expectancy, and mounting financial pressure on Social Security are reshaping the retirement conversation. The concept of a fixed retirement age is giving way to something more fluid, more individualized, and more complex.

The future of retirement in the United States may no longer revolve around a single number.

How Longer Life Expectancy Changed the Equation

When Social Security was established in the 1930s, average life expectancy was dramatically lower than it is today. Many Americans did not live long beyond their early 60s. The system was designed for shorter benefit periods and a different economic landscape.

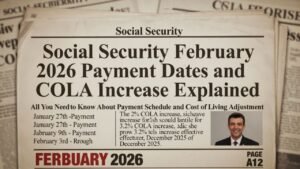

Fast forward to 2026, and the picture looks very different. Many retirees now live into their late 70s, 80s, or even 90s. While this reflects major progress in healthcare and quality of life, it also creates financial strain. Longer retirements mean benefits must stretch across more years.

As lifespans increase, policymakers are evaluating whether the current full retirement age of 67 remains sustainable. The possibility of gradually raising that age for younger generations has become part of broader Social Security reform discussions.

Why Social Security Is Under Financial Pressure

Social Security operates largely on a pay-as-you-go system. Today’s workers fund the benefits of today’s retirees. But demographic shifts are altering the balance.

Several key trends are contributing to financial stress:

- An aging population with more retirees drawing benefits

- Lower birth rates resulting in fewer workers entering the workforce

- Increased longevity extending benefit payout periods

Current projections indicate that, without legislative adjustments, the Social Security trust fund could face funding challenges in the coming decade. While this does not mean benefits would disappear, it signals that reforms may be necessary to preserve long-term stability.

Raising the full retirement age is one of several options being debated, alongside adjustments to payroll taxes or benefit formulas. None of these solutions are simple, and each carries significant implications for future retirees.

What a Higher Retirement Age Could Mean

If the full retirement age were to rise beyond 67 for younger workers, the impact would be gradual rather than immediate. Historically, increases have been phased in over time to give workers the opportunity to adjust their planning strategies.

It is important to remember that Americans can still claim Social Security as early as age 62. However, claiming early permanently reduces monthly benefits. On the other hand, delaying benefits beyond full retirement age increases monthly payments, with the maximum benefit typically available at age 70.

These decisions carry long-term financial consequences. For many households, the difference between claiming at 62 versus 70 can amount to thousands of dollars annually.

In a landscape where retirement age expectations may shift, understanding these trade-offs becomes even more critical.

Retirement Is Becoming More Personalized

The traditional model of working full-time until 67 and then fully retiring no longer fits everyone’s reality.

Many Americans are choosing alternative paths, including:

- Phased retirement, gradually reducing work hours

- Consulting or part-time work after leaving full-time employment

- Entrepreneurship later in life

- Delaying retirement to strengthen savings

Retirement today often blends income, flexibility, and lifestyle choices rather than representing a clean break from the workforce.

For some, continuing to work longer is a financial necessity. For others, it is a strategic decision to maximize benefits or remain professionally engaged. The common thread is flexibility.

The Human Side of Working Longer

While policy discussions often focus on numbers and projections, the human impact cannot be ignored.

Not all careers age equally. Individuals in physically demanding jobs may find it difficult to extend their working years. Health concerns, caregiving responsibilities, and workplace age discrimination are real challenges.

An office professional may be able to work comfortably into their late 60s or early 70s. A construction worker or healthcare aide may face very different physical realities.

As retirement policy evolves, flexibility will likely play a central role. A one-size-fits-all retirement age does not reflect the diverse nature of the American workforce.

Planning for a New Retirement Era

With uncertainty surrounding long-term Social Security reforms, proactive planning is essential.

Key strategies include:

Building Independent Savings

Relying solely on Social Security may not provide sufficient income for a comfortable retirement. Contributing consistently to retirement accounts, employer-sponsored plans, or diversified investment portfolios strengthens long-term security.

Understanding Benefit Timing

The age at which you claim Social Security significantly influences your lifetime income. Evaluating health status, life expectancy, marital considerations, and overall financial position can guide a more informed decision.

Maintaining Career Flexibility

In a shifting retirement landscape, adaptability is an asset. Continuing education, skill development, and professional networking can extend earning potential later in life.

Managing Healthcare Planning

Healthcare expenses remain one of the largest unknowns in retirement. Preparing for medical costs, insurance premiums, and long-term care considerations should be part of every comprehensive plan.

The Psychological Shift Around Retirement

Beyond policy and finances, retirement at 67 has long symbolized a cultural milestone. Letting go of that fixed expectation requires a mindset adjustment.

Retirement is increasingly viewed as a phase rather than a date. It may unfold gradually, blending work, leisure, family commitments, and financial transitions.

For younger generations especially, retirement planning may center less on a specific age and more on achieving financial independence and flexibility.

Final Thoughts

The idea of retiring at 67 once felt definitive. Today, it is becoming more fluid.

Longer life expectancy, demographic changes, and financial pressures are pushing Social Security into a new era. While no immediate change may affect current retirees, younger workers should recognize that the retirement landscape is evolving.

Rather than relying on a fixed age as a finish line, successful retirement planning now demands adaptability, early preparation, and informed decision-making.

Retirement is no longer about reaching one number. It is about building a strategy resilient enough to thrive in a changing financial world.