The Social Security February 2026 payment schedule has been officially confirmed, offering clarity and reassurance to millions of Americans who rely on these monthly benefits. For retirees, individuals living with disabilities, and eligible survivors, Social Security is not supplemental income—it is the financial backbone of everyday life.

From housing costs and utilities to healthcare premiums and groceries, many households structure their entire monthly budget around these deposits. Knowing exactly when funds will arrive provides stability, confidence, and peace of mind.

Even though February is the shortest month of the year, beneficiaries can expect payments to follow the same structured system used throughout the calendar year.

Why February Often Raises Concerns

Every year, February generates questions about potential delays. With fewer days on the calendar, it is natural for recipients to wonder whether payments might be shortened, postponed, or adjusted.

However, the Social Security Administration (SSA) does not base payments on the number of days in a month. Benefit amounts remain unchanged, and payment dates follow a fixed distribution schedule. Whether a month has 28, 29, 30, or 31 days, the structure remains consistent.

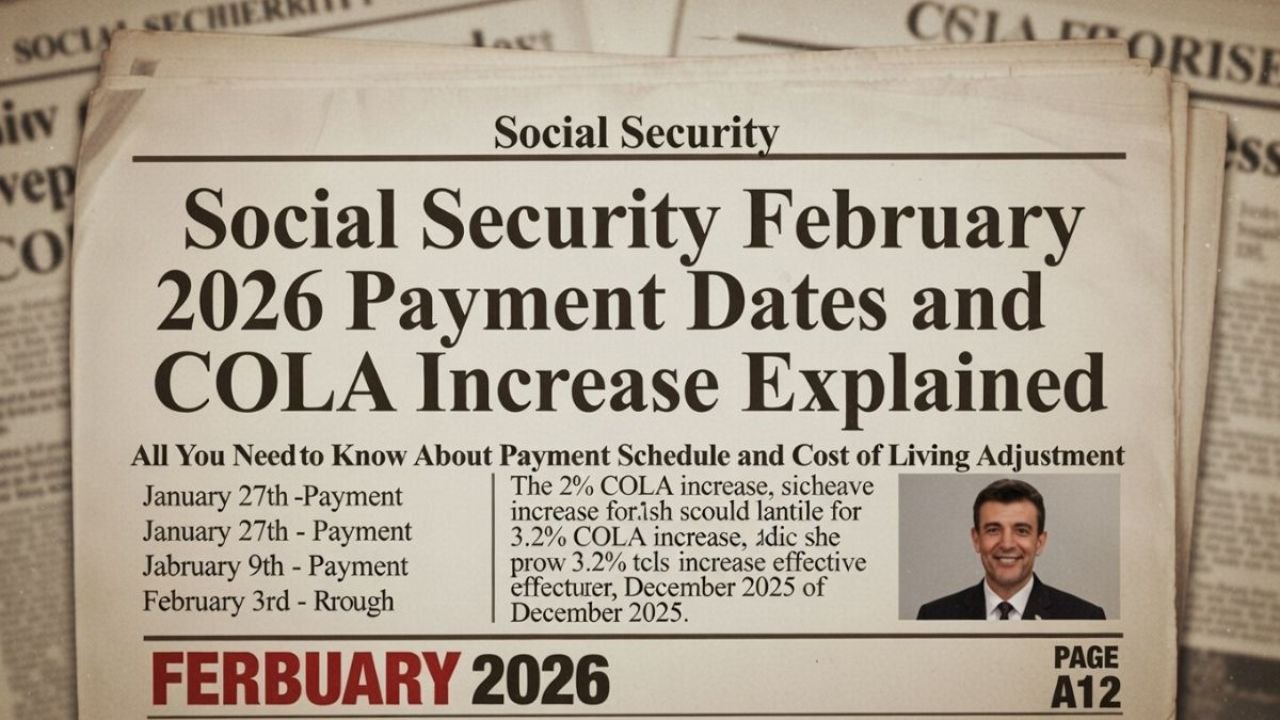

For February 2026, there are four official payment dates, and beneficiaries can expect their deposits according to the standard rules.

How the SSA Determines Payment Dates

The SSA uses a staggered payment system to ensure efficient processing for tens of millions of beneficiaries. Instead of issuing all payments on a single day, the administration distributes them across multiple dates each month.

Two primary factors determine an individual’s payment date:

- The date they first began receiving Social Security benefits

- Their date of birth

This structured approach reduces strain on financial institutions, minimizes processing delays, and ensures smoother nationwide distribution.

Once you know your assigned category, your payment date remains predictable from month to month.

February 3 Payments for Long-Term Beneficiaries

The first confirmed payment date for February 2026 is February 3.

This date applies to:

- Individuals who began receiving Social Security benefits before May 1997

- Certain beneficiaries who receive both Social Security and Supplemental Security Income (SSI)

For this group, payments are issued at the beginning of each month, regardless of birth date.

Funds are typically delivered through:

- Direct deposit into a bank account

- Direct Express debit card

- Paper check (for the small percentage still receiving mailed payments)

Because this group receives benefits early in the month, many long-term recipients find budgeting more straightforward.

Birth Date-Based Payments: February 11, 18, and 25

For beneficiaries who started receiving Social Security in May 1997 or later, payment dates are tied to birth dates. This system has been in place for decades and ensures an organized and evenly distributed payment schedule.

February 11, 2026

If your birthday falls between the 1st and 10th of any month, your Social Security payment will arrive on February 11.

February 18, 2026

If you were born between the 11th and 20th, your payment date is February 18.

February 25, 2026

Those born between the 21st and 31st will receive their February payment on February 25.

Once you identify your birth date category, your payment timing remains consistent every month, making long-term financial planning easier.

Why Direct Deposit Is the Preferred Method

The vast majority of beneficiaries now receive payments through direct deposit. This method offers several advantages:

- Faster access to funds

- Reduced risk of lost or stolen checks

- Greater reliability during holidays or weather disruptions

- Immediate confirmation of deposit

Electronic payments are processed efficiently, and funds are typically available on the morning of the scheduled date.

For those still receiving paper checks, transitioning to electronic delivery can reduce uncertainty and streamline access.

What If Your Payment Does Not Arrive?

In most cases, Social Security payments arrive on schedule. However, minor delays can occur due to bank processing times, weekends, or federal holidays.

If your payment does not appear on the expected date, the SSA recommends waiting up to three business days before reporting it as missing.

During that time:

- Check your bank account carefully

- Review your Direct Express balance

- Confirm that no banking details have changed

If the payment still does not arrive after three business days, contacting the Social Security Administration directly is the appropriate next step. Most issues are resolved quickly once reported.

Why the Confirmed Schedule Matters

For many households, timing is everything.

Mortgage payments, rent, credit card due dates, and insurance premiums are often aligned with Social Security deposits. A clear, confirmed payment calendar reduces anxiety and prevents costly late fees.

With official February 2026 payment dates set for:

- February 3

- February 11

- February 18

- February 25

beneficiaries can plan their finances with certainty.

Financial stability often begins with predictability. Knowing when income arrives allows recipients to schedule automatic bill payments, manage cash flow, and make informed spending decisions.

Staying Informed Throughout the Year

Although the payment structure remains stable, it is important to:

- Keep personal information updated with the SSA

- Ensure banking details are accurate

- Monitor official communications for any policy updates

Benefit amounts may change annually due to cost-of-living adjustments (COLA), but the underlying payment schedule format typically remains consistent.

Using official SSA resources is always the best way to confirm payment information specific to your situation.

Final Thoughts

The Social Security February 2026 payment schedule is officially confirmed, and beneficiaries can expect deposits on February 3, 11, 18, or 25, depending on their eligibility category and birth date.

Despite February’s shorter calendar, payments will be issued on time and in full according to established guidelines.

For millions of Americans, Social Security represents stability in an increasingly complex financial landscape. With confirmed deposit dates and a predictable structure, recipients can move through February with clarity, confidence, and control over their monthly planning.