As the 2026 tax season progresses, millions of taxpayers claiming the Earned Income Tax Credit are learning that their refunds will not arrive on the same timeline as standard tax refunds. The Internal Revenue Service has confirmed that EITC-related refunds will be delayed again this year, with most payments scheduled for mid to late March 2026. While this delay often sparks concern, it is a long-standing policy rooted in federal law and fraud prevention measures.

Understanding why EITC refunds are delayed, who is affected, and what the realistic payment timeline looks like can help taxpayers plan more effectively and avoid unnecessary stress.

What Is the Earned Income Tax Credit?

The Earned Income Tax Credit is a refundable tax credit designed to support low- to moderate-income workers and families. Unlike nonrefundable credits, the EITC can generate a refund even if no federal income tax is owed. This makes it one of the most valuable credits for eligible households, particularly those with children.

Eligibility depends on several factors, including earned income, filing status, and the number of qualifying dependents. Because of its value and broad reach, the EITC is also one of the most closely reviewed credits by the IRS.

Why EITC Refunds Are Delayed Every Year

EITC refunds are delayed due to federal legislation that requires additional verification before funds are released. The goal is to reduce improper payments, identity theft, and fraudulent claims. These safeguards are designed to protect taxpayers and the integrity of the tax system, but they also extend processing times.

Key reasons for the delay include:

- Mandatory income verification using employer and third-party data

- Dependent eligibility checks across multiple filings

- Identity confirmation procedures

- Automated fraud detection reviews

These steps take time and cannot be bypassed, even for taxpayers who file early and accurately.

IRS 2026 EITC Refund Timeline Explained

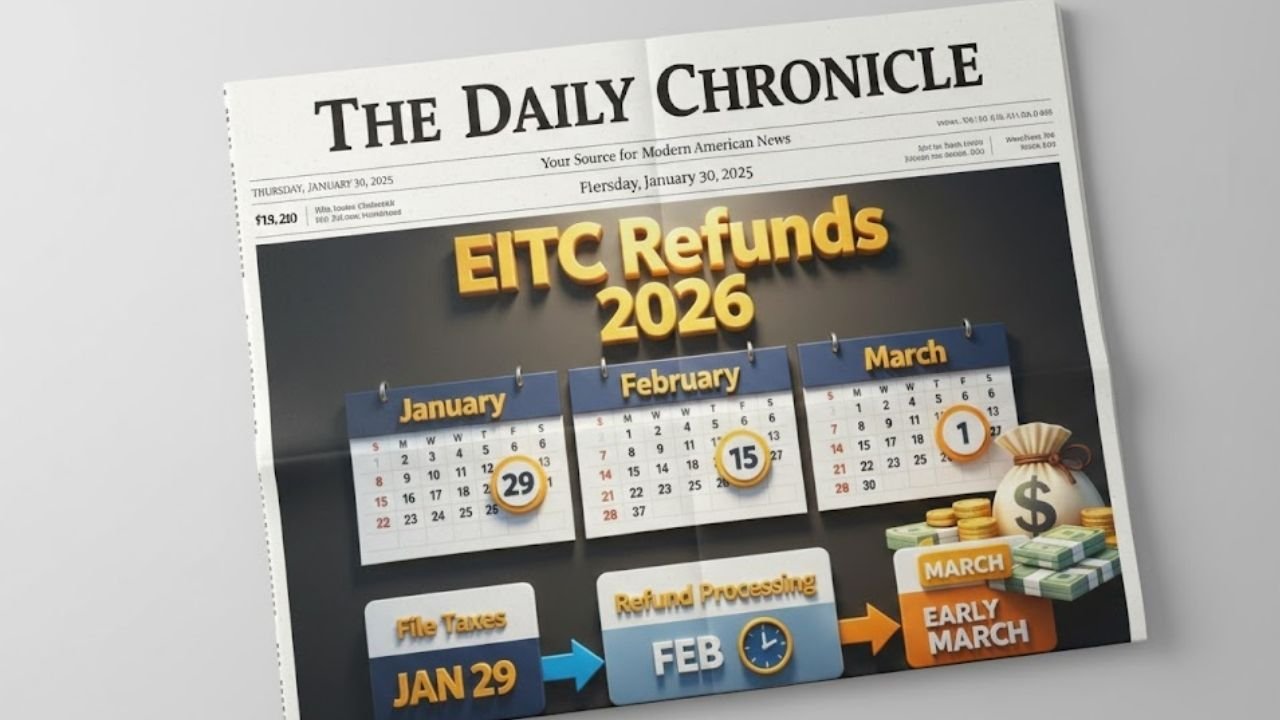

For the 2026 filing season, the IRS has outlined a clear but later-than-average schedule for EITC refunds.

Filing Period

Taxpayers can file EITC-eligible returns as soon as the IRS opens the filing season in mid to late January.

Processing Phase

Although returns may be accepted quickly, EITC refunds are held during a mandatory review period. During this time, the IRS verifies income, dependents, and filing details.

Expected Payment Window

Most EITC refunds are expected to be issued between mid and late March 2026. This applies even to early filers who submit returns in January.

Payment Method Impact

Taxpayers using direct deposit typically receive funds sooner than those receiving paper checks. Mailed refunds may arrive several days or weeks after electronic deposits.

Who Is Affected by the EITC Refund Delay?

The delay affects all taxpayers claiming the Earned Income Tax Credit, regardless of filing accuracy or income level within the eligible range. This includes:

- Single filers with qualifying income

- Married couples filing jointly

- Families with one or more qualifying children

- Workers without dependents who meet EITC criteria

The delay is not a penalty and does not indicate a problem with the return. It is a standard part of EITC processing.

How EITC Delays Differ From Standard Refund Delays

Standard tax refunds are usually issued within 21 days of acceptance, assuming there are no errors or verification issues. EITC refunds, however, are legally required to follow a longer timeline.

Unlike mid-season backlog delays caused by high filing volume, EITC delays apply even when IRS systems are operating normally. This distinction is important, as many taxpayers mistakenly assume something is wrong when their EITC refund does not follow the standard schedule.

How to Track Your EITC Refund Status

The IRS provides official tools to help taxpayers monitor their refund progress.

The most commonly used option is the “Where’s My Refund?” portal and mobile app. To access updates, taxpayers need:

- Social Security number

- Filing status

- Exact refund amount claimed

During the EITC holding period, the status may show that the return is being processed without providing a specific deposit date. This is normal and does not require action.

Common Reasons EITC Refunds May Take Even Longer

While most EITC refunds arrive in March, some may take additional time due to:

- Incorrect or mismatched Social Security numbers

- Missing or inconsistent income information

- Errors related to dependent claims

- Requests for additional documentation

Responding promptly to any IRS notices helps prevent further delays.

Tips to Avoid Unnecessary EITC Processing Issues

Although the March delay cannot be avoided, taxpayers can reduce the risk of extended waits by following best practices:

- File electronically instead of mailing a return

- Use direct deposit with a verified bank account

- Double-check income figures and dependent details

- Avoid estimating numbers when exact figures are available

- Retain copies of all tax documents

Accuracy plays a critical role in smooth processing once the mandatory review period ends.

Planning Ahead for the March Timeline

For many households, EITC refunds represent an important financial resource. Knowing that payments will arrive in March rather than February allows for more realistic budgeting and planning.

Taxpayers relying on refunds for major expenses should factor the delayed timeline into their financial decisions and avoid depending on early-season deposit rumors.

Final Verdict

The EITC refund delay in 2026 is not a system failure or a new policy shift. It is a continuation of established IRS procedures designed to protect taxpayers and reduce fraud. While waiting until March can be challenging, especially for households counting on the funds, the delay applies to all EITC claimants equally.

Filing early, submitting accurate information, choosing direct deposit, and monitoring official IRS tools remain the most effective ways to ensure refunds are released as soon as legally permitted.

Disclaimer: This article is for informational purposes only. Refund dates, eligibility rules, and processing timelines may vary based on individual filings and IRS procedures. Taxpayers should rely on official IRS resources or qualified tax professionals for personalized guidance.